Table Of Content

In a shared building, the HOA might take care of most maintenance. Homeowners insurance costs more in places where homeowners file more claims. A local insurance agent might be happy to give you an idea about prices in the area since you could become a future client. If you just want to ballpark it, the national average annual premium for a $250,000 home is about $1,100 (about $92/month).

Other Factors That Influence How Much House You Can Afford

If you want to shrink your debt-to-income ratio before applying for a mortgage — which is likely a good idea — pay off your credit cards and other recurring debts, like student loans and car payments. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results.

Homeowners Association Fees

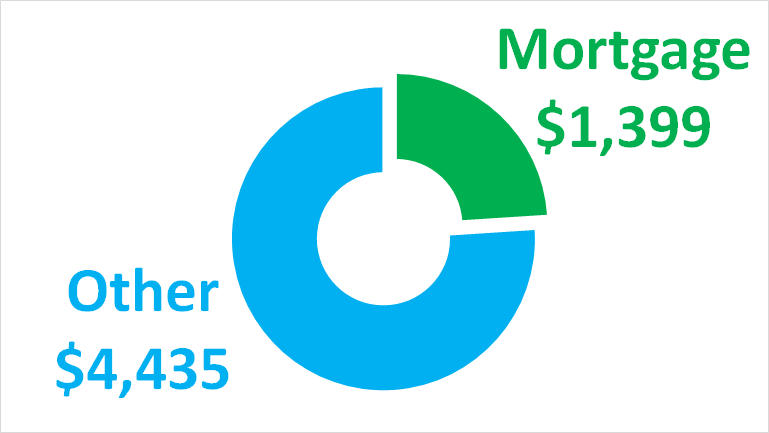

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of an unexpected event. Ultimately, how much home you can afford depends on your financial situation and preferences. It requires a more comprehensive decision than just how much money you want to spend on mortgage payments each month. If you get a $200,000 mortgage with a 15 year fixed rate at 5%, your monthly payments will be $1,582 (excluding taxes and insurance). Although your DTI and housing expense ratios are important factors in mortgage qualification, other variables impact your monthly mortgage payment and how much you can afford.

How does credit score impact affordability?

However, these loans are geared toward buyers who fit the low- or moderate-income classification, and the home you buy must be within a USDA-approved rural area. The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach.

And you’re not alone—78% of homebuyers had to finance their home purchase in 2022, according to the National Association of Realtors. Before you get a mortgage, it’s critical to know how much home you can afford, especially as homes become more expensive. The amount of cash a borrower pays upfront to buy a home; it goes toward the purchase price with mortgage loans typically used to finance the remaining amount. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

Things No One Tells You About Buying a Home Chase - Chase News & Stories

Things No One Tells You About Buying a Home Chase.

Posted: Mon, 04 Dec 2023 19:58:45 GMT [source]

Additionally, interest rates offered for VA loans often turn out to be lower than those offered for conventional loans. The annual percentage rate (APR) is a number designed to help you evaluate the total cost of a loan. In addition to the interest rate, it takes into account the fees, rebates, and other costs you may encounter over the life of the loan. The APR is calculated according to federal requirements, and is required by law to be included in all mortgage loan estimates.

You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments. Your reserve could cover your mortgage payments - plus insurance and property tax - if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. Homeownership comes with unexpected events and costs (roof repair, basement flooding, you name it!), so keeping some cash on hand will help keep you out of trouble. This can mean private mortgage insurance (PMI), which is an added monthly charge to secure your loan.

Mortgage Calculators

The 28/36 Rule is a qualification requirement for conforming conventional loans. Home prices have been on a rollercoaster ride in recent years and are still very high, as are mortgage rates. It’s enough to make you wonder whether now is even a good time to buy a house. It’s important to focus on your personal situation rather than thinking about the overall real estate market.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. We believe everyone should be able to make financial decisions with confidence.

Both the upfront fee and the annual fee will detract from how much home you can afford. Loans, grants, and gifts are three ways to supplement your savings for a down payment. Use the home affordability calculator to help you estimate how much home you can afford. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Find out what you'd owe each month given a specific purchase price, interest rate, length of your loan, and the size of your down payment. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. A report made by a qualified person to estimate the value of a property, often used to help determine an appropriate loan limit.

For example, with a $100,000 annual salary, you can afford a $300,000 house based on the maximum multiplier. However, you might be able to afford a more expensive home if you can secure a low interest rate or have enough money saved up for a large down payment. A good answer would be a home that you won’t regret buying and one that won’t have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money. The best-case scenario is getting the seller to pay closing costs without increasing the purchase price. It may be hard to get this concession in a seller’s market, but it may be doable in a buyer’s market.

Let's take a look at a few hypothetical homebuyers and houses to see who can afford what. A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try SmartAsset's free online matching tool.

You have to make the mortgage payments each month and live on the remainder of your income. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. An FHA loan is government-backed, insured by the Federal Housing Administration.

FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. Estimate your monthly payments, closing costs, APR and mortgage interest rate today.

Our simplified and secure online mortgage application will walk you through the process step by step. Some features of the online application are not available with all loans; talk to a home mortgage consultant. If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence. This ratio is known as the debt-to-income ratio and is used for all the calculations of this calculator. There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation.

No comments:

Post a Comment